Village Savings and Loans Associations (or VSLAs) keep economic power local and community-based, offering a sustainable means for breaking the cycle of poverty. Here’s how they work.

Maria Kasongo Mwabana had lost everything. The 36-year-old mother of ten and her family watched as their village of Kabutonga (in Tanganyika Province, DRC) was attacked and destroyed in 2019. Fortunately, they survived, relocating roughly 20 miles away. But when they felt safe enough to return home, they had to begin from scratch.

“I had five children when we fled. When we arrived, there was too much suffering,” she recalls of their displacement in Kabimba village. “All we could do was cultivate and farm for other people. We received assistance from an NGO.”

As part of Concern’s EAST Program in the Democratic Republic of the Congo, Maria received livelihood support from Concern, including agricultural supplies, cash transfers, and training. She also joined a Concern-supported village savings and loans association (VSLA).

“Now we are at the level we were at [before we had to leave],” she tells us now. She has her eyes set on more and — with the support of her VSLA — that’s a very real possibility.

What are VSLAs?

Village savings and loans associations are small, member-run microfinancing groups that help people living in poverty build up their savings and community cohesion, while also being able to take out loans and emergency insurance at low interest rates.

Originally developed in 1991 by Concern’s partner, CARE International, VSLAs epitomize the old adage: “If you want to go far, go together.” By pooling their savings and self-managing loan distributions, VSLAs help their members — and their entire community — sustainably achieve economic stability.

How do VSLAs work?

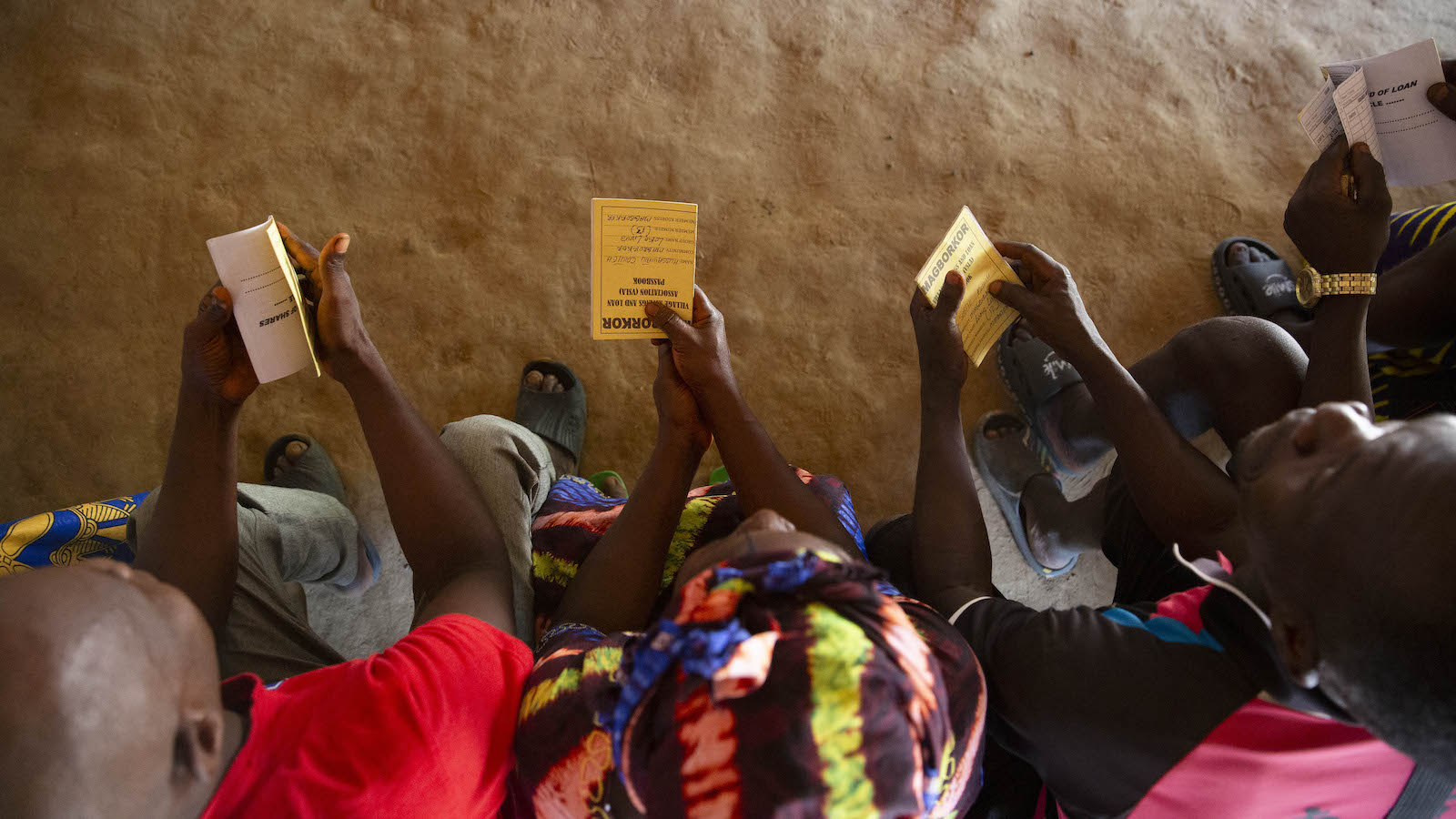

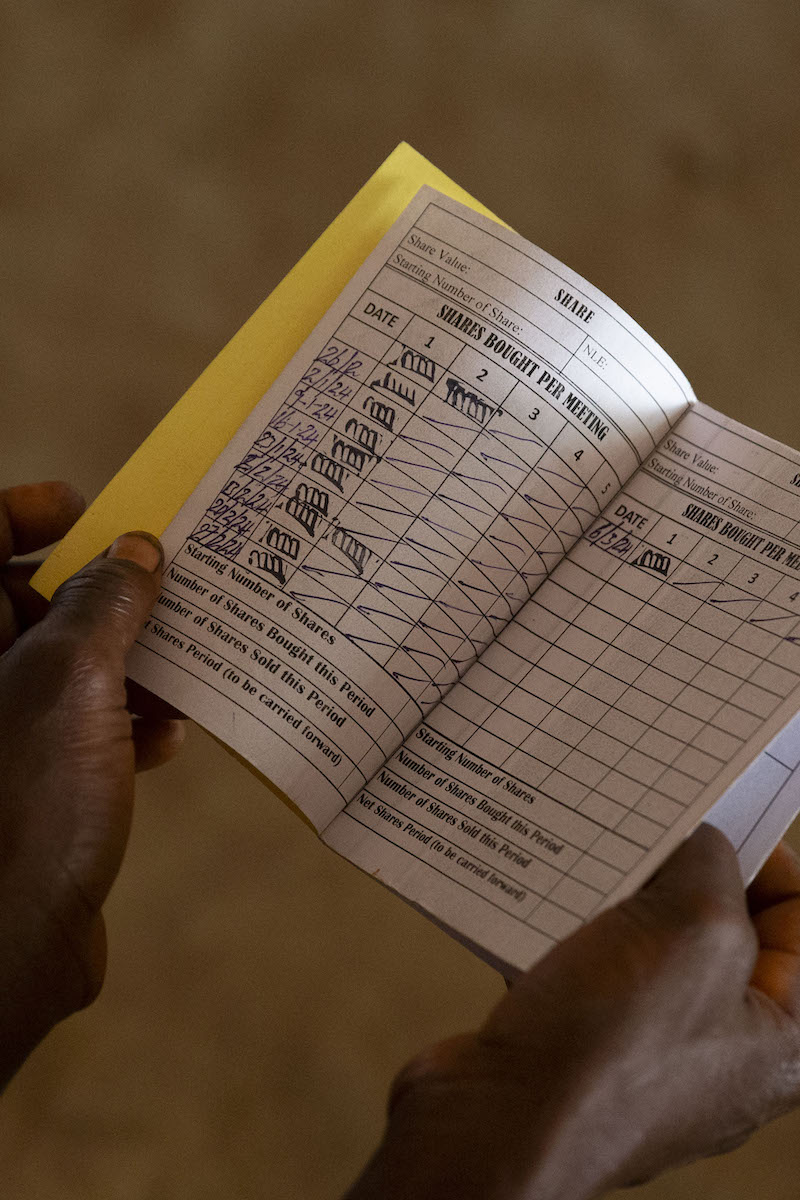

Part of the success of VSLAs over the last three decades is how simple the program is. Each association comprises a small team of members who buy shares into their group. They meet weekly and continue to invest a little bit of their income, pooling these investments together to create a sum greater than its parts. Each year, the fund and its interest is distributed to the members according to their stake in the group, and they can start again.

Throughout the year, members are able to take out loans as needed. Instead of needing to sell a major asset or cut down on meals or medical care (or take out loans at much higher, predatory rates), VSLA loans have lower interest rates (set by the group), and members are able to use their shares in the group as collateral.

VSLAs are also relatively easy to set up with a lockable cash box, a calculator, pens, booklets, and initial training. Concern facilitators lead sessions on how to run the group, as well as financial literacy, bookkeeping, and other related topics. From there, groups have it in hand. Concern-organized VSLAs function as part of larger livelihoods projects. This means that participants usually receive some initial cash grants from us that can be used for their initial investments in their VSLA.

“Even in a bank, you cannot just go and get a loan”

Several hours north of Kabutonga is the village of Mangothe, where Concern also runs the EAST Program. The Mangothe VSLA, near the city of Beni, has 22 members and has been running for nearly a year. One of its members is 48-year-old Bernadette Katungu Kamatogha, who relocated to the area after violence in her home village.

“What I like about the training is that I am acquiring strategies on how I can be able to teach my children or other people,” she says of the program. The daughter of a school teacher, Bernadette saw many similarities between the approaches and techniques from her Concern facilitator and her father.

Bernadette was also able to see her children further educated thanks to a $20 loan from her VSLA, which covered both school fees for them and some medical expenses for herself. “I was happy receiving these loans because even in a bank, you cannot just go and get a loan from there without being known.” Bernadette was among the 99% of borrowers who are able to repay their VSLA loans, a success rate that is unmatched by other borrowing options.

99% of all VSLA loans in the last 30+ years have been repaid in full.

“We got enough money and solved all our issues” (or, why VSLAs work)

Across the border from DRC in the central province of Gisagara, Rwanda, Anonciata Niyitegeka explains why her VSLA is popular within the community rather simply: “We got enough money and solved all our issues.”

The emphasis here is “we.” Members of Anonciata’s group have been able to rent land and purchase fertilizer, buy homes, get medical care when sick, buy school uniforms and meals, and pay their electricity bills. “We can go to the market with something to sell. We no longer have problems buying soap to wash with. We get enough food, and food that we want.”

VSLAs choose their own members and are run democratically, with several roles elected each year (roles like president, vice-president, secretary, and treasurer). Group decisions are also done through voting, making decisions as a team. This is usually easy to do as groups are organized around shared goals.

With a few years of experience as the accountant for her VSLA (which began in 2020 as part of Concern Rwanda’s Graduation program), Anonciata adds that her group has expanded as more village residents heard about the success the initial members were having. For them, this has increased community cohesion and support as they work to break the cycle of poverty.

“Even when some things don’t go well, such as when some of our livestock died, we continue on. We aren’t discouraged,” she adds. “That’s how the group is proceeding. We are still helping each other.”

Concern’s work to end poverty

Ending poverty is the core mission of Concern. All of our programs and approaches are designed to further progress towards this goal by addressing some of the root causes of poverty.

Our approaches to this are rooted in an understanding that poverty is a cycle: Those with the fewest resources and methods to handle risks (such as natural disasters or conflict) stand to lose the most, and have even fewer resources when the next emergency hits. These pockets of poverty become the hardest to eliminate. We work to address both these inequalities and risks, enabling communities — especially those furthest behind — to build both a safety net for immediate shocks and livelihoods to support themselves and their families in the longer term.

This approach allowed us to reach 27.3 million people across 27 countries and territories last year, with programs focused on emergency response, livelihoods, health and nutrition, and education.